It is neither a perfect bill nor a good-looking calf, said Sen. Jeff Siddoway, a rancher by profession and chairman of the Senate Local Government and Taxation Committee.

But the bill — a $20 million partial repeal of the personal property tax — is a first step toward repealing this tax and offering businesses a “fatted calf,” said Siddoway.

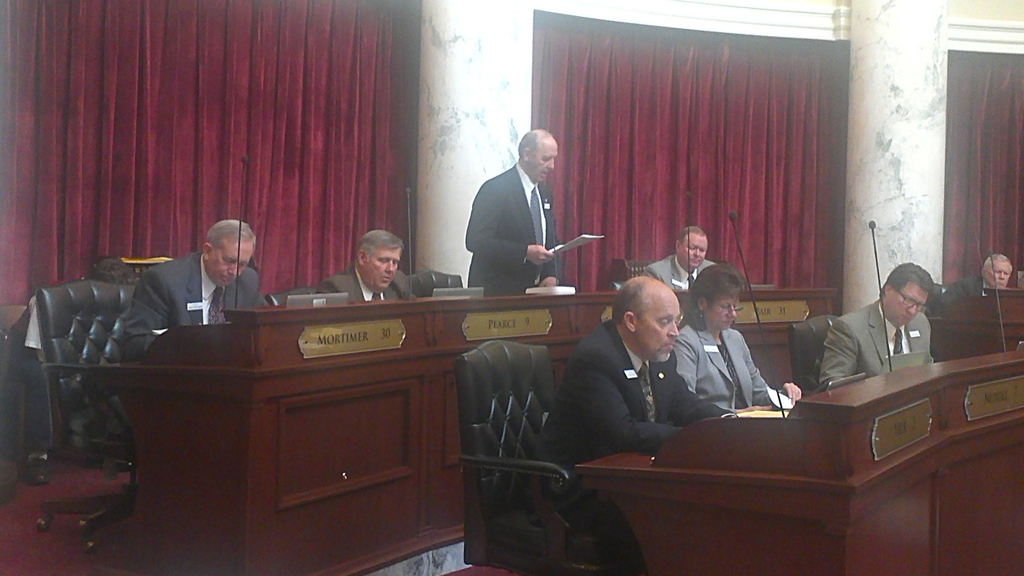

“This bill has been dead so many times, I can’t believe it’s here,” said Siddoway, minutes before the Senate approved the personal property tax cut on a 35-0 vote. “We’ve to pump a bunch of grain in this over the next few years.”

The partial repeal — drafted by the Idaho Association of Counties and supported by the Idaho School Boards Association and the Idaho Association of School Administrators — allows businesses an exemption on the first $100,000 of “personal property,” such as equipment and furnishings. Under the partial repeal, 90 percent of Idaho businesses would no longer be subject to the tax, and reporting requirements many business owners consider onerous.

House Bill 315 found favor with education groups that believe a partial repeal best protects the schools’ short- and long-term interests.

They pointed out that the $20 million in property tax relief will be reimbursed through state sales taxes — keeping some 900 local taxing districts, including school districts, unharmed. They also said the partial repeal would minimize the shift of property taxes to homes, farmland and other real property — a drastic change in the tax structure that could jeopardize future school bonds and property tax levies.

According to 2012 State Tax Commission estimates, public schools received $38.6 million from personal property taxes. This represents about 9 percent of schools’ overall property tax collections, but eight rural districts collect at least a third of their property taxes from business personal property.

Tuesday’s Senate vote ends a session-long struggle over how best to reduce the unpopular personal property tax. The Idaho Association of Commerce and Industry supported a full repeal, a $120 million tax cut. HB 315 now goes to Gov. Butch Otter, who supports personal property tax relief and is likely to sign it.