Idaho’s supplemental school levy bill has set another record — for the sixth consecutive year.

Idaho’s supplemental school levy bill has set another record — for the sixth consecutive year.

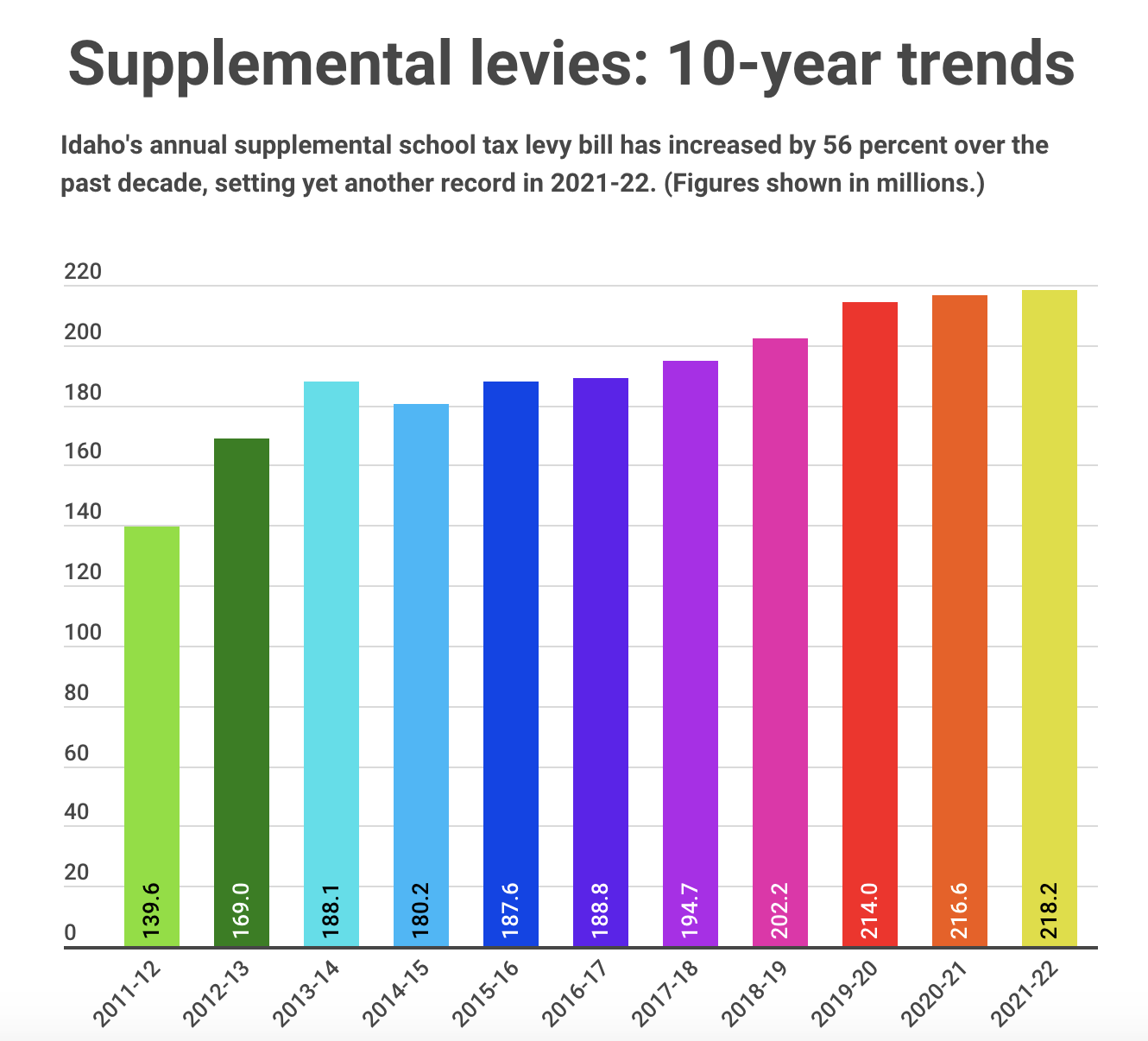

All told, property owners will bankroll more than $218.2 million in supplemental levies this school year, up about $1.6 million from last year’s record bill.

The one- or two-year voter-approved levies have become a mainstay for the vast majority of Idaho’s 115 school districts, which use the money to pay for anything from staffing and salaries to extracurricular programs and safety measures. But the supplemental levy bill continues to climb, even as Idaho school districts sit on another huge source of one-time money: a historic infusion of federal coronavirus relief money, largely unspent.

And at the same time, the levies have become a focal point in the debate over property taxes — which figures to be a key topic during the 2022 legislative session, which opens Monday.

Here are some key numbers, obtained by Idaho Education News from the State Department of Education:

- Eighty-nine school districts will collect a supplemental levy this year — the lowest number since 2012-13. Last year, 92 districts ran levies. (The Firth, Plummer-Worley and Bruneau-Grand View school districts fell off the list this year; Bruneau-Grand View voters rejected a levy in March 2021.)

- The Coeur d’Alene School District still is receiving the largest supplemental levy in Idaho: a $20 million-a-year levy, renewed by voters in March. Rounding out the statewide top five: Lewiston, $18.8 million; West Ada, $14 million; Nampa, $12.9 million; Lake Pend Oreille, $12.7 million.

- Central Idaho’s remote Mackay School District collects the state’s smallest supplemental levy, $75,000.

Most supplemental levies, large and small, easily surpass the simple majority needed to pass.

However, some legislators want to reduce the schools’ reliance on the supplemental levy — or eliminate the levies entirely.

In 2021, Sen. Carl Crabtree, R-Grangeville, and Rep. Judy Boyle, R-Midvale, floated a $42 million bill to cover the cost of all-day kindergarten, to shift the cost of extended kindergarten off of the supplemental levy and onto the state’s tax rolls. That bill didn’t get a full hearing, but similar all-day kindergarten bills are likely to surface this session.

Sen. Jim Rice — a Caldwell Republican who chairs the Senate Local Government and Taxation Committee — has floated a proposal to phase out the supplemental levies. The state would replace the property taxes by earmarking a half a cent from Idaho’s existing 6% sales tax. But this earmarked sales tax would generate $180 million a year, less than the $218 million schools will receive in supplemental levies this year. (More about Rice’s proposal from Kelcie Moseley-Morris of the Idaho Capital Sun.)

Idaho Education News data analyst Randy Schrader contributed to this report.